This article covers all aspects of Jio Financial Services’ Share Price Target from 2025 to 2050. Jio Financial Service Ltd is one of the leading brand in the Financial Services sector, which provide high returns to its investors. In the last 5 years, the company has provided a share return of 52.63%. Read the entire post to know about the Financial Overview, Future Potential growth, and share price prediction. Stay tuned with us for more details.

About Jio Financial Services Ltd

Jio Financial Services Limited is a prominent Financial Services company of India. It is a leading player in the Financial Services Industry. The company was originally incorporated in July 1999 under the Companies Act 1956. In 2002, the company changed to Public Limited, and the name was Reliance Strategic Investments Limited. In July 2023, Jio Financial Services Limited was incorporated.

However, Jio Financial Services is a subsidiary of Reliance Industries (RIL). JFSL is an NBFC-ND-SI registered with the RBI. The Jio Financial Services Ltd is a holding company and operates its financial services business through its consumer-facing subsidiaries, namely Jio Finance Limited (JFL), Jio Insurance Broking Limited (JIBL), Jio Payment Solutions Limited (JPSL) and a joint venture, namely Jio Payments Bank Limited (JPBL).

The financial services business of Reliance Industries Ltd got demerged into Jio Financial Services. The company received the final approval from the RBI to become a Core Investment Company – Non-Deposit taking – Systemically important Company from an NBFC in July 2024. The company’s major business areas are Insurance Broking, Payments Bank, Payment Solutions, Loans & Leasing.

Historical Share Price of Jio Financial Services

After the demerger of Jio Financial Services Ltd, it was listed on the stock exchanges on 21 August 2023. Following the split and listing, JFSL was briefly part of the Nifty 50, BSE Sensex and FTSE indices, but was removed from these indices in the following weeks as it did not meet their inclusion criteria. From August to December 2023, the share price increased by +₹22.25 (10.37%).

JFSL has increased by +₹61.30 (25.16%) during the period from January 2024 to December 2024. It had increased by +₹76.55 (35.69%) since the listing on the Stock Exchange. Here is the return of the JFSL over the period:

| Time Period | Returns |

| One Year (1Y) | -41.90 (-12.58%) |

| Five Year (5Y) | +76.20 (35.52%) |

| All Time | +76.20 (35.52%) |

Jio Financial Services Ltd Fundamental Analysis

| Metric | Value |

| Market Cap | ₹ 2,07,816 Cr. |

| 52-Week High | ₹ 363 |

| 52-Week Low | ₹ 199 |

| Face Value | ₹ 10.0 |

| Book Value | ₹ 194 |

| Return on Equity (ROE) | 1.23 % |

| Return on Capital Employed (ROCE) | 1.47 % |

| P/B Ratio | 1.66 |

| P/E Ratio | 127.4 |

| Dividend Yield | 0.00 % |

| Sales Growth (YoY) | 17.97 (March 2025) |

| Profit Growth (YoY) | 1.76% (March 2025) |

| Promoter Holding | 47.12% |

| Net Profit Margin | 68.47% (March 2025) |

| Debt-to-Equity Ratio | 0.0321 (March 2025) |

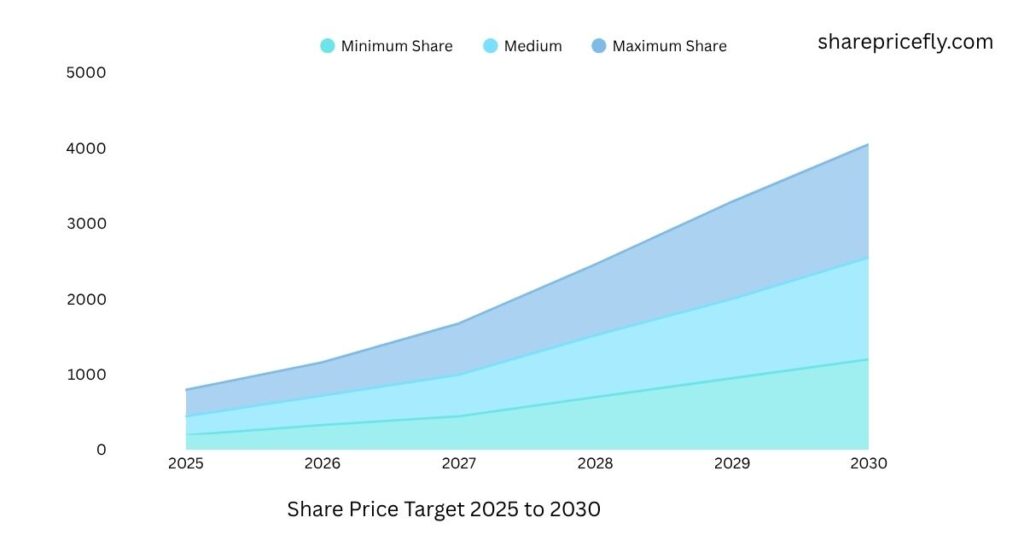

Jio Financial Services Share Price Target 2025

Jio Financial Service Share Price jumped by 46.5% in the past 2 months from March to May 2025. Now, it ranges up to ₹286+ in June 2025. Telecom-based JIO financial services can give a range of share prices between ₹195 and a maximum of ₹350 in 2025

| JOIFIN Share Price Target 2025 | Amount in Rupees |

| Minimum Share Price | ₹195 /- |

| Maximum Share Price | ₹ 350 /- |

Read Also: Safe Enterprises Retail Fixture Share Price Target 2025 to 2050

Jio Financial Services Share Price Target 2026

The touch a maximum share price of ₹381.75 in its share market journey, but 2025 recorded an instant drop in share of up to 63% from 1st January to 1 March 2025, which shocked every investor in JIOFIN, but it was a product of worldwide share drop due to American Tariff rates revision. Now share price has started to recover again and is expected to touch a range of ₹330 to ₹440 in 2026.

| JOIFIN Share Price Target 2026 | Amount in Rupees |

| Minimum Share Price | ₹330 /- |

| Maximum Share Price | ₹440 /- |

Jio Financial Services Share Price Target 2027

Quarterly report of March 2025 has been published, which reports a 10.90% hike in revenue with 462 crores rupees value and a 1.76% increment in net income with 316 crores. This is a positive growth in the past 3 months, which can give a minimum share price of ₹445 to a maximum share price of ₹680 in 2027 if they follow the same flow of growth.

| JOIFIN Share Price Target 2027 | Amount in Rupees |

| Minimum Share Price | ₹446 /- |

| Maximum Share Price | ₹680 /- |

Jio Financial Services Share Price Target 2028

Management of JIOFIN has managed a strong base of assets worth 1,34,00,000 crores. While they have liabilities of 10,013 crore rupees, which are recoverable and give a positive vibe to ensure a futuristic vision of the company. Which to this analysis, the share price of JIOFIN can range from ₹700 to ₹940 in 2028.

| JOIFIN Share Price Target 2028 | Amount in Rupees |

| Minimum Share Price | ₹700 /- |

| Maximum Share Price | ₹940 /- |

Jio Financial Services Share Price Target 2029

Jio Financial Services had only 51.69 crores revenue and 31.25 crores net income in 2023, but the company grew its revenue and net income by 3462% and 5034% in 2024 with ₹1842 crores revenue and 1605 crores net income. This boom can look like an unpredictable hike in share price, but it has a strong team behind it. So, owners are expected to give a share price range of Rs. 950 to max. Rs. 1290 in 2029.

| JOIFIN Share Price Target 2029 | Amount in Rupees |

| Minimum Share Price | ₹ 950 /- |

| Maximum Share Price | ₹1290 /- |

Jio Financial Services Share Price Target 2030

JIO has a wide range of customers in India, where most of the smartphone users are using the JIO telecom services. The company is expanding its arms and offering financial services, including JIO loan, Insurance, Digital banking, JIO UPI, etc. The combined links between the business of the company are expected to reach more higher price in future, where they can range a share price between 1200 rupees to Rs. 1500 by the end of 2030.

| JOIFIN Share Price Target 2030 | Amount in Rupees |

| Minimum Share Price | ₹1200 /- |

| Maximum Share Price | ₹1500 /- |

Jio Financial Services Share Price Target 2035

JIO is promoting 5G internet connectivity while users are switching on online, e-services, including banking and financial services. The company is promoting its financial services through the database, based on the JIO App, where users are using JIO UPI to redeem multiple coupons on the app. JIO is expecting to grow its financial services with more eff,ects by 2035 where investors can see a share prica e of ₹2500 tom 2700 rupees in 2035

| JOIFIN Share Price Target 2035 | Amount in Rupees |

| Minimum Share Price | ₹2500 /- |

| Maximum Share Price | ₹2700 /- |

Read Also: Reliance Power Share Price Target 2025 to 2050

Jio Financial Services Share Price Target 2040

JIOFIN is expanding its business where they firstly provide UPI, bankinincludes and included, including loans, Insurance, and now offering lease facilities where you can borrow items from lease form JIO assets. While the JIO payment bank is not getting popular but if this idea runs, then investors can expect a share price of ₹4000 to ₹4400 in 2040.

| JOIFIN Share Price Target 2040 | Amount in Rupees |

| Minimum Share Price | ₹4,000 /- |

| Maximum Share Price | ₹4,400 /- |

Jio Financial Services Share Price Target 2045

Long-term investment in JIO FIN can be helpful for earlier investors as ithe the t is backed by the 17th richest person in the world, Mukesh Ambani, according to the Bloomberg Billionaires Index. Share prices are expected to range from ₹5200 to ₹5800 by the end of 2045.

| JOIFIN Share Price Target 2045 | Amount in Rupees |

| Minimum Share Price | ₹5200 /- |

| Maximum Share Price | ₹5800 /- |

Jio Financial Services Share Price Target 2050

A long-term investment requires a focused decision. No tool can determine the share price of JIOFIN in 2050. The upcoming years are very re where whereonary, where technology is adding new features per day. So the digitally efficient services of JIO Financial services share at asharess atga e of share per price between ₹9,000 to ₹11,400 in 2050.

| JOIFIN Share Price Target 2050 | Amount in Rupees |

| Minimum Share Price | ₹9,000 /- |

| Maximum Share Price | ₹11,400 /- |

Read Also: Advik Capital Share Price Target 2025 to 2050

Jio Financial Services Share Price Target 2025 to 2050: An Overview

| Year | Targeted Share Price Range (₹) |

|---|---|

| 2025 | ₹195 – ₹350 |

| 2026 | ₹330 – ₹440 |

| 2027 | ₹446 – ₹680 |

| 2028 | ₹700 – ₹940 |

| 2029 | ₹950 – ₹1,290 |

| 2030 | ₹1,200 – ₹1,500 |

| 2035 | ₹2,500 – ₹2,700 |

| 2040 | ₹4,000 – ₹4,400 |

| 2045 | ₹5,200 – ₹5,800 |

| 2050 | ₹9,000 – ₹11,400 |

Jio Financial Services Ltd Investment Opportunity & Risk

Here are the Risk and Opportunity Factors regarding investing in the Jio Financial Services Investment. Let’s explore below:

Risk Factors of Investing in Jio Financial Services Ltd

The Jio Finance Services Ltd share price declined by 7.20% in just one year, which raises concerns among investors. The company has a poor Return on Equity (ROE) track record of 3.32%. The company has a poor ROCE track record of 3.59% over the last 3 years. The company is trading at 8.23 times the book value. PAT margin has shrunk by 15.12%.

Opportunity Factor of Investing in Jio Financial Services Ltd

Jio Financial Services is a key player in the Industry of Financial services industry in India. The company is almost debt-free and has also maintained a good ROA of 3.21% over the last 3 years. The company’s operating income has grown well for the company over the past 3 years: 3 years CAGR 31.14%. The JFSL has delivered substantial profit growth of 45.94% over the past 3 years.

As per the March 2025 reports, the company’s revenue increased by 10.90% and net income increased by 1.76%. However, the company also recorded a decline of -8.24% in Net Profit Margin. These factors indicate the potential for returns by investing in this stock.

Jio Financial Services Ltd Peer Comparison

| Stock Name | M. Cap (Cr) | 1 Yr Return (%) | P/E (TTM) | PB Ratio |

|---|---|---|---|---|

| Bajaj Finance Ltd | 5,819.68 | +30.67% | 34.98 | 6.02 |

| Jio Financial Services Ltd | 2,075.94 | -7.59% | 128.73 | 1.51 |

| Cholamandalam Investment & Finance Company Ltd | 1,369.31 | +13.20% | 32.13 | 6.40 |

| Shriram Finance Ltd | 1,329.25 | +19.76% | 13.91 | 2.54 |

| Muthoot Finance Ltd | 1,053.4 | +43.44% | 19.87 | 3.96 |

| SBI Cards & Payment Services Ltd | 906.9 | +30.50% | 47.33 | 6.93 |

| Sundaram Finance Ltd | 574.8 | +9.38% | 30.58 | 4.59 |

Jio Financial Services Ltd Shareholding Patterns

| Category | Shareholding (%) |

|---|---|

| Promoter | 47.12% |

| Public | 26.83% |

| FII | 11.66% |

| Other Institutions | 7.8% |

| Mutual Funds | 6.58% |

Conclusion

Jio Financial Services Ltd is one of the prominent players in the Financial Services Industry. The company has reported impressive financial performance and has continuously shown sales and profit growth. It is expected to perform best in the next quarter. It has the potential to give a high return in the upcoming years. It is one of the multibagger stocks of the Finance sector. Investors should analyse all microeconomic factors before investing. As per the expert opinion, this stock is best for long-term investment.

Disclaimer: Stock market investments are subject to risks. The provided information is given for educational purposes. The predictions provided are based on research and past trends, and investors should do their analysis before making financial decisions. Make sure to ask and consult with industry experts and investors.